After years of discussion and development, 2024 is set to be the year that the hydrogen engine market really takes off. Jamie Fox, principal analyst electric vehicles with off-highway market intelligence leader Interact Analysis, considers the market

***

Off-road

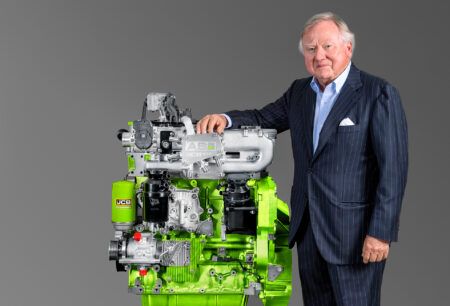

The off-road market, which stood at zero in 2023 (JCB has already built many H2 ICE vehicles but not sold them for commercial use), is forecast to grow to 23 vehicles in 2024, led by loaders from JCB. Sales of hydrogen ICE telehandlers are also anticipated in the coming years, with the total off-road market projected to reach 2,720 H2 ICE vehicles in 2030. However, this figure must be compared with the millions of (mostly diesel) off-road vehicles sold each year.

The order Deutz received from China for gensets, plus the possibility of other orders in this area, will also add to the sales of hydrogen ICE off-road vehicles during the next few years.

Most H2 ICE sales are forecast to be in trucks

Market drivers

Sales, mainly of H2 ICE trucks, off-road machinery/vehicles and gensets are driven by the need to avoid reliance on foreign energy (in India) and for environmental reasons – climate change and local pollution (in Europe, the US and elsewhere). In addition, hydrogen engines are somewhat similar to diesel engines, and can be produced by companies with the expertise and production facilities for diesel.

Given these reasons, there will always be national or local governments, or large companies willing to take a chance on a new technology, but early sales don’t necessarily mean that a mass market will follow.

In our experience, conducting modelling and interviews with experts for the last seven years, increasing sales of a new technology from 1%-2% to 5%-10% will only happen when the new technology is less expensive or clearly better in some way than the prevalent technology, or when existing technology is being legislated against in some way. The path to mass market H2 ICE looks very challenging given that the total cost of ownership of H2 ICE vehicles is more expensive than diesel and BEV vehicles, does not offer greater utility or more advantages vs diesel, and the existing diesel is not currently being phased out (especially in off-road). In addition, the infrastructure for hydrogen is not in place at present.

Diesel will be phased out earlier on-road than off-road, but in most on-road applications BEV will simply beat H2 ICE on cost, and perhaps infrastructure. Long-haul trucking is more of an open question as that is very difficult for BEV which means H2 ICE may be able to compete.

H2 ICE won’t reach level of BEV or diesel

The no 1 reason why we think H2 ICE will be a niche application is that it will (in total cost of ownership) be too expensive. The high cost of hydrogen as a fuel, even after 2030, is the key problem here. The second big reason is the lack of infrastructure (at least for now). It may make sense to use hydrogen vehicles near to existing sources of hydrogen – such as industrial facilities, ports and solar and wind farms that are creating hydrogen with spare electricity through electrolysis. In such cases, infrastructure costs and the costs of hydrogen transport may be reduced, allowing hydrogen vehicles to be competitive.

Engineering challenges

On a positive note, the engineering challenges that H2 ICE engines and vehicles face are being solved. Much progress has been made by companies such as JCB and Cummins on challenges relating to spark plugs, embrittlement and so on. Injector lifetime, given the lack of lubrication, is still very poor but many companies are confident that they will improve it.

So if the issues around cost and infrastructure could be solved, hydrogen would have a bright future in commercial vehicles.

New Research Report

These findings are from our new H2 ICE report, which has H2 ICE vehicle forecasts to 2040 by region, vehicle/equipment type, and power/size. Direct injection vs port fuel is also shown. The report compares our forecasts for H2 ICE with those of fuel cell, battery electric, hybrid and non-electrified vehicles (mainly diesel). In addition, the report forecasts the price of hydrogen and has a sample total cost of ownership for Hydrogen ICE and how this compares to other powertrains.

The report also showcases leading suppliers, pros and cons of each supplier, and technical, market and legislative arguments to provide a complete picture of the market.

For more information about Interact Analysis’s Hydrogen ICE -2024 report, please get in touch with Jamie Fox