Off-highway vehicle OEM CNH Industrial has announced it is to acquire Raven Industries, a US-based leader in precision agriculture technology for US$1.2bn.

The acquisition builds upon a long partnership between the two companies and will further enhance CNH Industrial’s position in the global agriculture equipment market by adding strong innovation capabilities in autonomous and precision agriculture technology.

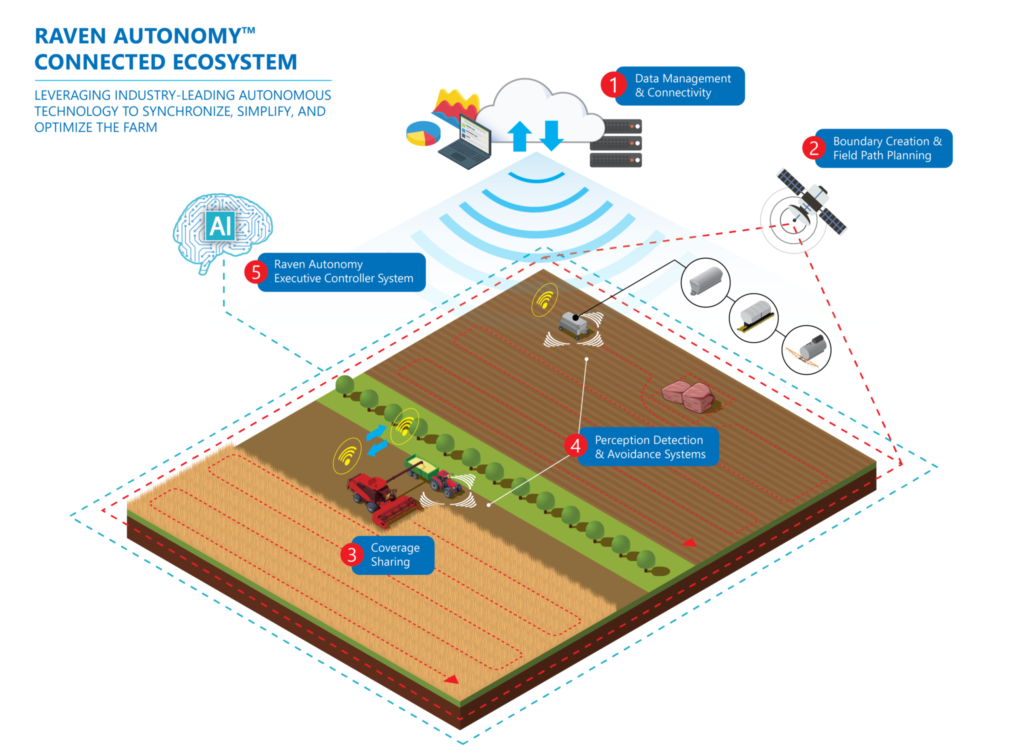

“Precision agriculture and autonomy are critical components of our strategy to help our agricultural customers reach the next level of productivity and to unlock the true potential of their operations,” says Scott Wine, CEO, CNH Industrial. “Raven has been a pioneer in precision agriculture for decades, and their deep product experience, customer driven software expertise and engineering acumen offer a significant boost to our capabilities.

“This acquisition emphasizes our commitment to enhance our precision farming portfolio and aligns with our digital transformation strategy. The combination of Raven’s technologies and CNH Industrial’s strong current and new product portfolio will provide our customers with novel, connected technologies, allowing them to be more productive and efficient.”

“Our board and management are excited about this partnership and what it means for our future,” said Dan Rykhus, president and CEO of Raven Industries. “For 65 years, our company has been committed to solving great challenges. Part of that commitment includes delivering groundbreaking innovation by developing and investing in our core capabilities and technology.

“By coming together with CNH Industrial, we believe we will further accelerate that path as well as bring tremendous opportunities and value to our customers — once again fulfilling our purpose to solve great challenges. Our relationship with CNH Industrial has expanded over decades, and we have a deep respect for one another and a shared commitment to transform agriculture practices across the world. We look forward to CNH Industrial leveraging the Raven talent and culture, as well as the Sioux Falls community, as part of their vision and future success.”

Headquartered in Sioux Falls, South Dakota, Raven Industries is organized into three business divisions: Applied Technology (precision agriculture), Engineered Films (high- performance specialty films) and Aerostar (aerospace) with consolidated net sales of US$ 348.4 million for the twelve months ended January 31, 2021. The company is a global technology partner for key strategic OEMs, agriculture retailers and dealers. The transaction is expected to generate approximately US$400 million of run-rate revenue synergies by calendar year 2025, resulting in US$150 million of incremental EBITDA from synergies.

The transaction to acquire 100% of the capital stock of Raven Industries, values the company at US$58 per share, representing a 33.6% premium to the Raven Industries 4-week volume-weighted average stock price, and will be funded with available cash on hand of CNH Industrial. Closing is expected to occur in the fourth quarter of 2021, subject to the satisfaction of customary closing conditions, including approval of Raven shareholders and receipt of regulatory approvals.