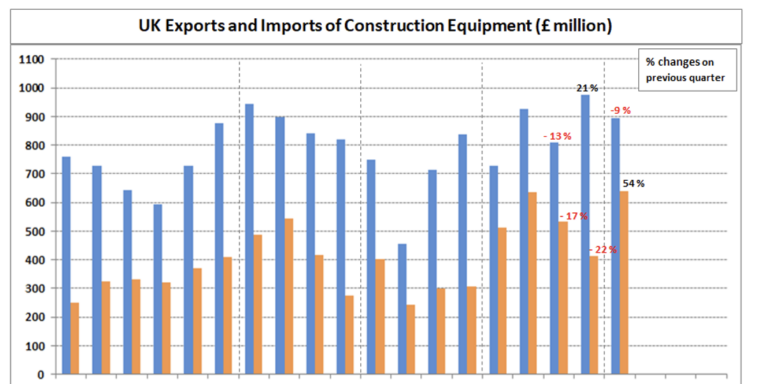

In Q1 of this year, UK imports of construction and earthmoving equipment showed an exceptional 54% increase on the previous quarter, and matched the record quarterly level seen in Q2 last year since trade has been monitored from 2013.

Imports and exports of construction and earthmoving equipment both recorded very high levels of trade, but with different patterns compared with the previous quarter. Whilst imports accounted for £637 million in Q1, and was consistent with equipment sales in the UK remaining at very high levels in the first quarter of the year, exports saw a 9% decline in Q1 compared with the previous quarter. However, this was a comparison with the highest quarterly level reached in Q4 last year since trade has been monitored since 2013.

While imports showed a 54% increase in £ value terms in Q1, the increase on a tonnage shipped basis was 35% compared with Q4 2021. This significant difference can be attributed to the higher prices being seen for equipment due to increases in the price of steel and some other products used in machine manufacture. The EU share of total imports in Q1 saw a recovery to 69%, returning to the levels seen in 2020. This followed a reduced level of 63% in 2021, which was attributed to a post Brexit effect.

Exports of equipment in Q1 were £893 million, as highlighted above. This represented a reduction on Q4 2021 levels, but was still one of the highest quarterly totals in recent years. The share of exports to the EU remained on a downward trend in the first quarter, falling to 42%, after being at 47% in 2021. After EU share of exports had shown a growing trend in earlier years, the reduced levels in 2021 and Q1 this year could be attributed to a post Brexit effect. An update on total tonnages shipped in 2021 still isn’t available for this report due to problems with some of the tonnage data in Q3, which haven’t been corrected by customs yet.

The UK remained a net exporter of construction and earthmoving equipment in Q1 2022, with exports (£893 million) 40% higher than imports (£637 million). However, this was a much smaller margin than in 2021 overall, when exports were 64% higher than the level of imports.