Retail sales of construction and earthmoving equipment bounced back in June after falling below 2022 levels in May. Sales in June were over 8% above the levels in the same month last year and this included very strong sales of mini/midi excavators, the most popular product in the UK. As a result, sales in Q2 ended up at 3% above the second quarter last year.

Sales in the first half of the year have reached 19,600 units which is 7% ahead of the first half of 2022. While current sentiment in the market is still anticipating a modest downturn in sales in the second half of the year, this will be from “record” high levels achieved in the first half of the year.

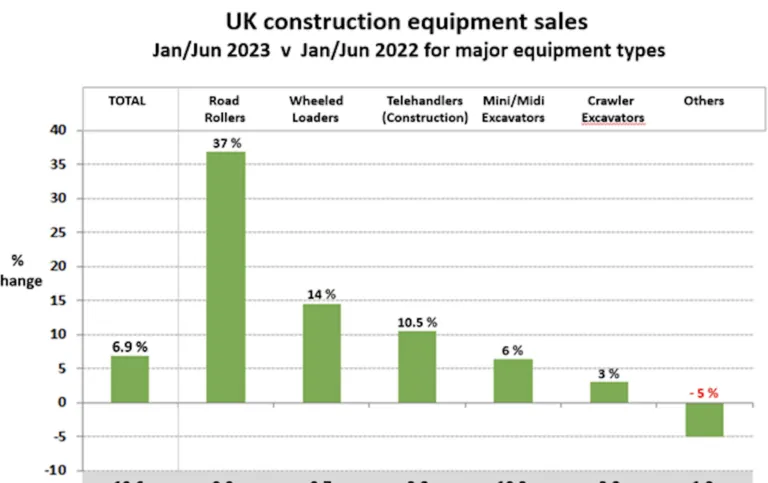

The pattern of sales for the major equipment types is shown in the second chart below which compares sales in the first half of the year with the first six months of 2022. This shows percentage changes in sales for the different machine types. At this stage, road rollers are showing the strongest growth at 37% above last year’s levels, following very strong sales in June. Only the low-volume products have shown weaker sales than last year in the first six months (-5%), grouped together as “Others” in the chart below.

The pattern of sales on a regional basis in the UK and N Ireland is shown in the map below for the first six months of the year compared with the first half of 2022. This continues to show a mixed pattern across the regions. The strongest sales so far this year are still in Scotland and the South East of England, where sales remain around 30% ahead of last year’s levels. Only three regions are seeing lower growth than last year, consisting of the North West of England (-16%), Northern Ireland (-5%) and London (-4%).

Equipment sales in the Republic of Ireland are also reported in the statistics exchange. Sales in May and June were at similar levels to 2022, and sales in the first half of the year are 3% above last year’s levels, due mainly to a very strong first quarter.