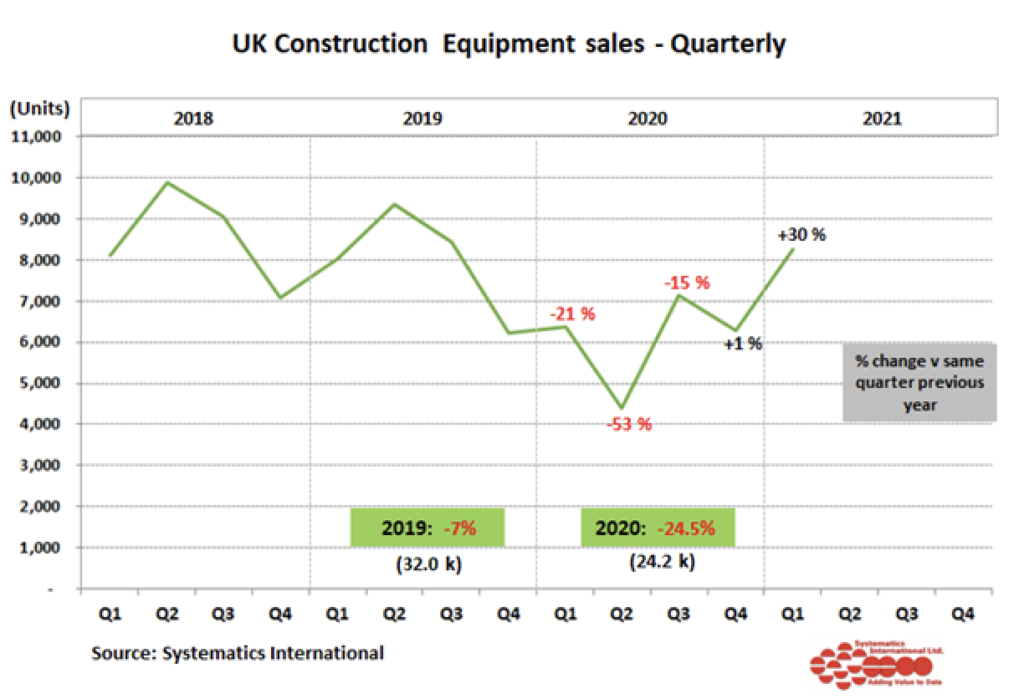

Retail sales of construction and earthmoving equipment in March were close to double the levels seen in March last year when the impact of Covid was felt for the first time. As a result, sales in the first quarter were 30% above 2020 levels and reached over 8,000 units.

Sales in the first quarter of the year were expected to show a big increase on last year due to the pandemic, so it is interesting to compare sales with Q1 2019 to put the strength of the recovery into context. This shows that sales this year were 2.9% above 2019 levels and suggest significant momentum in the market in the early months of the year. While concerns remain that equipment sales could be held back this year due to supply-side constraints for some components, there is growing confidence that sales should see a strong recovery for the full year.

The pattern of sales for the major equipment types in the first quarter of the year is shown in the chart below. This shows that the growth in sales is still being driven by excavators. Mini/Midi excavators (up to 10 tonnes) and other crawler excavators saw the strongest growth compared with Q1 last year. Amongst the other equipment types, road rollers and telehandlers (to the construction industry) also showed strong recoveries in the first quarter.

The construction equipment statistics exchange covers sales on a regional basis in the UK and N Ireland. The map below shows the percentage differences for sales in the main regions in Q1 2021 compared with the same quarter last year. Sales in the South East were the strongest (+39%), while Wales saw the weakest sales in the first quarter, still 2% below last years’ levels.

Sales in the Republic of Ireland are also recorded in the statistics scheme, and saw a more modest increase in March compared with the UK. This resulted in Q1 sales this year ending up at 12% above 2020 levels.