As the world emerges from the aftermath of the Covid-19 pandemic, updated research by Interact Analysis reveals that the off-highway vehicle market has experienced strong growth. In part, this has been driven by a pandemic ‘bounce-back’. However, a huge uptake in electrified forklifts and material handling equipment, and a strong construction industry are also fueling growth. Despite this, global events such as the Ukraine-Russia conflict and ongoing supply chain disruptions are expected to have a continuing impact on the off-highway vehicle market. In particular, the Chinese off-highway machinery market suffered a difficult year in 2022.

In the long term, market growth for the off-highway vehicle sector looks set to remain positive due to strong investment in warehousing solutions, India’s pledge to mechanize agriculture and the US’s investment in infrastructure. In the short term, the extended lockdown period in China has had an unprecedented downward impact on market growth within the APAC region, while ongoing freight delays and component shortages have impacted the ability of manufacturers to meet demand. In 2022, OEMs experienced very strong order intakes, but due to supply chain disruption were unable to fully meet market demand, restricting growth.

The Chinese market performed worse than Interact Analysis forecast back in 2021 due to the country’s strict covid policies. Nevertheless, as the country represents the largest market for off-highway machinery it is expected to bounce back well in the coming years. This has led Interact Analysis to be more bullish with their forecasts for global electrification.

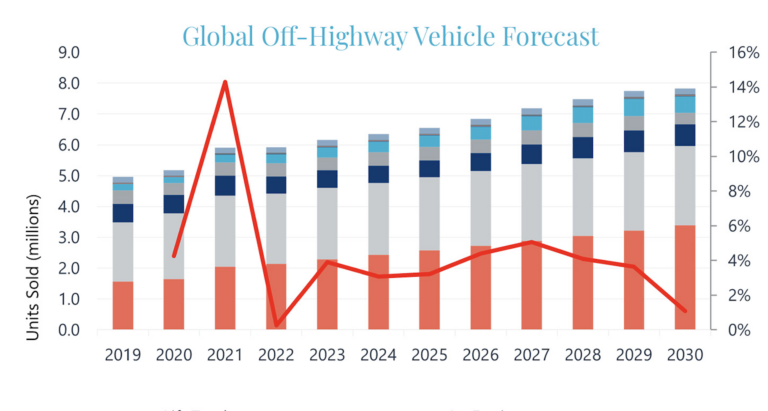

ABOVE: The off-highway machinery market bounced back well from the pandemic and growth forecasts remain positive out to 2027.

Electrification – and other alternative fuels – within the off-highway market is now well established. Almost all machine manufacturers have at least one – often several – battery electric or hydrogen models available to purchase or in the pipeline. Although hydrogen powertrains are becoming established in some material handling applications and in larger equipment, it is battery electric powertrains that are forecast to dominate in the long term when it comes to alternative powertrains.

“It’s promising to see that even some of the larger machinery types such as excavators and haul trucks are being electrified,” said Alastair Hayfield, senior research director at Interact Analysis. “Smaller machinery electrification has paved the way for this, enabling OEMs to experiment before moving on to larger, more complex machinery. Interact Analysis is more bullish on the demand for electric machinery versus its previous research. In years to come we can expect to see huge developments made toward electrification within the compact machinery market, particularly in Western Europe and China. The Netherlands, for example, is showing very positive signs for off-highway machinery electrification with an uptick in government funding and city bans on polluting vehicles driving this.”