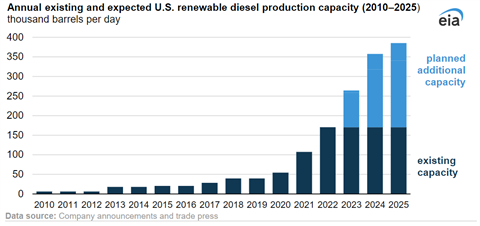

U.S. production capacity for renewable diesel could more than double from current levels by the end of 2025, based on several announcements for projects that are either under construction or could start development soon, according to the latest Today in Energy report from the U.S. Energy Information Administration (EIA).

ABOVE: Graph showing how the capacity for renewable diesel in US is set to double by 2025

The EIA report estimated U.S. renewable diesel production capacity was 170,000 barrels per day (b/d), or 2.6 billion gallons per year (gal/y), at the end of 2022. While the agency said it expects some announced projects will be delayed or canceled, if all projects begin operations as scheduled, U.S. renewable diesel production capacity could reach 384,000 b/d, or 5.9 billion gal/y, by the end of 2025.

Renewable diesel is a fuel that is chemically equivalent to petroleum diesel and nearly identical in its performance characteristics. Its chemical equivalence to petroleum diesel gives it a couple of advantages over biodiesel, one being that producers can distribute renewable diesel in petroleum diesel pipelines. A second advantage is that traditional diesel engines can consume any blend level of renewable diesel, including pure renewable diesel, with no significant side effects. In contrast, biodiesel can only be blended into petroleum diesel between 2% and 20% of the diesel fuel by volume.

Renewable diesel has some of the highest greenhouse gas (GHG) reduction scores among existing fuel pathways in programs such as the federal Renewable Fuel Standard (RFS), the California Low-Carbon Fuel Standard (LCFS), the Oregon Clean Fuels Program and the Washington State Clean Fuels Program.

Investment in new renewable diesel production capacity has recently grown significantly in the United States because of renewable diesel’s interchangeability with petroleum diesel in existing petroleum infrastructure and because of government incentives. In 2022 and early 2023, eight new renewable diesel refineries in Oklahoma, Texas, New Mexico, Wyoming, Montana, Nevada, Kansas and Louisiana, began production.

The production capacity currently scheduled to begin operation could allow renewable diesel to contribute to a greater share of West Coast diesel consumption, EIA said. Most renewable diesel in the United States has historically been consumed on the West Coast, where producers can take advantage of both RIN credits from the RFS and state credits from one of the state renewable fuel programs. An average of 520,000 b/d of distillate fuel oil was consumed on the West Coast in 2021. The region, which is also the largest renewable diesel importing region in the United States, could soon meet the majority of its distillate fuel needs from renewable diesel by 2025 if domestic renewable diesel capacity increases as scheduled.