According to a new study by research and consulting firm Fact.MR, over 12 million units of forestry machinery were sold in 2018, and sales are expected to record over 3% year-on-year growth in 2019. The forestry machinery industry has been upheld by a slew of factors, which span from a growing adoption of mechanized practices in forest harvesting, to rising trend of leasing & renting services and integration of GPS systems into the machinery.

The impact of digital technology on forestry is evident, with the paradigm shift from animal-powered to more mechanized processes. Global operators in the forestry industry are pioneering use of advanced technologies for enhancing the management results, which is emerging as the ‘precision forestry’ trend worldwide. Plantation forestry operators with a long-track record of continuous improvement and innovation are likely to gain the first-mover advantage from precision forestry practices in the near future.

New technologies, including unmanned aerial vehicles (UAVs) and LiDAR, are witnessing pervasive adoption in the forestry machinery industry, which have been helping operators in real-time surveillance and mapping activities. Advances, trails, and adoption of technologies in the forestry landscape show no signs of abating, involving activities in the overall value chain – from nurseries and plant genetics to delivery of wood to energy plants, pulp mills and saw mills.

Advanced genetic improvement best suited for genetic profiling of plants in terms of end-use, and automated nurseries for raising plants under optimum conditions for good health and growth, are some of the key practices, which have significantly underpinned the adoption of forestry machinery among harvesters worldwide. It is highly likely that technology will change the face of the forestry machinery market in the upcoming years, with key solutions such as IoT taking the landscape by the storm.

Advanced genetic improvement best suited for genetic profiling of plants in terms of end-use, and automated nurseries for raising plants under optimum conditions for good health and growth, are some of the key practices, which have significantly underpinned the adoption of forestry machinery among harvesters worldwide. It is highly likely that technology will change the face of the forestry machinery market in the upcoming years, with key solutions such as IoT taking the landscape by the storm.

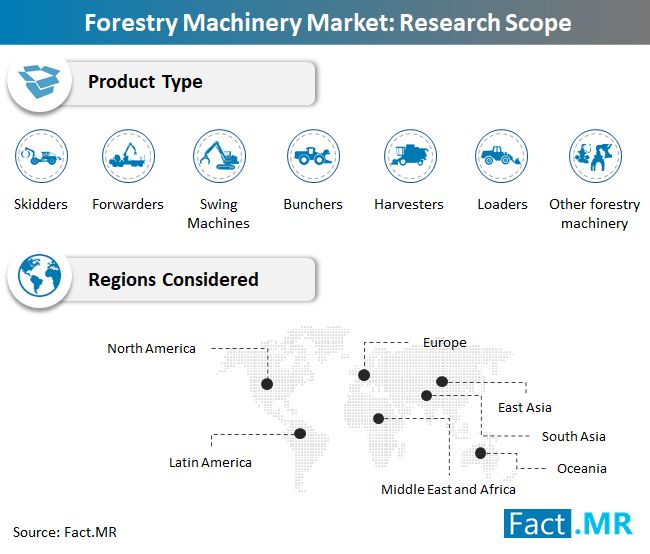

Volume sales of forestry machinery remain high in Europe, closely followed by North America – these two regions collectively accounting for over 70% of sales. Forestry machinery sales in Europe and North America are buoyed by a confluence of factors, including support for favorable funding policies of the government in terms of national development programs, along with rising adoption of key mechanized practices such as cut-to-length (CTL) approach.

Players will witness modest success rate in developed markets, where ROI are expected to be average while the competition remains high. In contrast, developing markets will present relatively greater ROI as well as success rate for the players in the forestry machinery market, as these regions witness growing adoption of precision forestry and mechanized practices, while competition remains comparatively low compared to developed markets.

Sensing varied requirement of end-users in the forestry machinery market, key players have introduced a variety of machinery, including skidders, bunchers, harvesters, forwarders, and loaders. Forwarders account for nearly 30% sales of forestry machine worldwide, primarily underpinned by increasing number of contracts between players and end-users, and product developments to cater demanding operations in extreme terrain conditions. Growing demand for optimized and fast transport of logged wood from forests to store landings will further contribute to the development and sales of forwarders in the foreseeable future.